Now as an expat you have probably already noticed that the Dutch take their biking pretty seriously. They’re everywhere! Maybe best not to go into all the details of why the Dutch love their two-wheeler so much – but actually, most of the time, it is easier to get anywhere in the Netherlands by bike than by car. Especially in the towns and cities. City centers are mostly car-free, making the bike the best option. As a result, the Dutch infrastructure is well-adapted with special bike lanes and so on. The result: the bike is a relatively safe mode of transportation. So become more like the Dutch and get on your (e)bike!

E-bike Insurance from Allianz Global Assistance

E-bikes are becoming more and more popular these days. If you look at all the bicycles sold in 2021, this popularity becomes abundantly clear. A whopping 52% of them are electrically powered and it is expected that the share of electric bicycles is going to increase over the years to come. E-bikes are more in demand than ever, which means it is time to start thinking about insuring your bicycle with an e-bike insurance.

Allianz Global Assistance insures all brands and bicycle types, including e-bikes. Have you bought a new electric mountain bike, e-cargo bike or perhaps an electric city bike from VanMoof? Great news! You can now insure your e-bike with a bicycle insurance from Allianz Global Assistance.

Two Insurances and Three Possible Packages

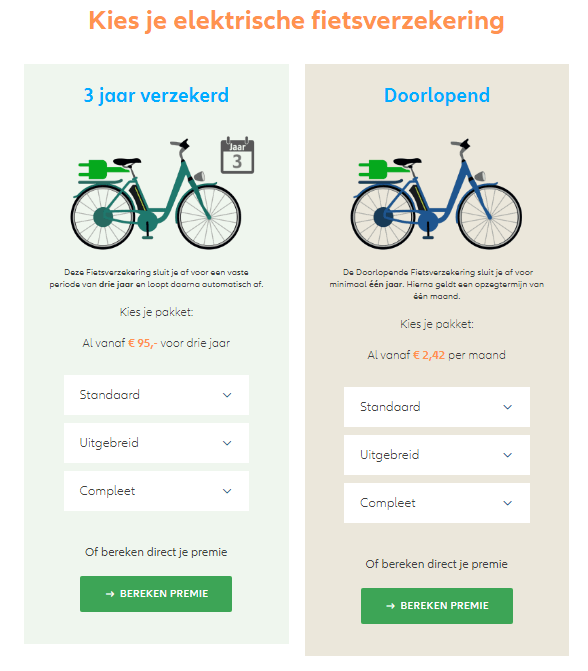

Insuring your bicycle via Allianz Global Assistance means you get to choose between two insurances:

- Aflopende fietsverzekering (= temporary bicycle insurance) which stops automatically after a period of three years.

- Doorlopende fietsverzekering (= annual bicycle insurance) which you take out for at least one year and that remains active, until you terminate it with one month’s notice.

Regardless of your choice, you are always insured for legal aid assistance, and you are covered for bicycle theft. Also, both insurances offer you the option of selecting one of these three packages:

- Standaard is the basic package that provides you with legal aid assistance and covers you for bicycle theft.

- Uitgebreid is a more extensive package that includes legal aid assistance and coverage for bicycle theft and damages.

- Compleet gives you all the possible coverages; legal aid assistance, bicycle theft, damages and roadside assistance for your bicycle.

The bicycle insurances are valid worldwide, although legal aid assistance is only provided in Europe. Roadside assistance is limited to the Netherlands and 30 kilometers across the Dutch border with Belgium and Germany.

What Are the Differences Between the Two Bicycle Insurances?

| Bicycle insurance | Bicycle insurance | Doorlopende fietsverzekering (= Annual bicycle insurance). |

| Payment | In advance and all at once | Periodic payment, per year or per month |

| Insure another bicycle | Not possible | Possible |

| Insurance ends | Automatically after three years or in the event your bicycle is stolen and you have received compensation. | The insurance runs for at least one year and after that a notice period of one month applies. If your bicycle has been stolen, you can insure a new bicycle on the policy. |

| Premium restitution | No | Yes, if applicable |

| Extended warranty for e-bike battery |

Yes | No |

Why Insure an e-Bike?

There are a number of good reasons to insure your e-bike with Allianz Global Assistance:

- insurance is suitable for all electrically powered bicycles1

- full purchase value of your e-bike covered2

- covered for bicycle theft and legal aid assistance

- possible to insure for bicycle damages and roadside assistance

- optional: extended warranty for e-bike battery.

1 = For speed pedelecs (also called high-speed e-bikes) you need a separate liability insurance that Allianz Global Assistance does not offer.

2 = For race bikes, ATBs and mountain bikes an excess applies in case of bicycle theft or damages to the bike.

How to Insure My e-Bike?

In order to insure your bicycle, you need to know a couple of things before you start:

| Bicycle type | What type of bike are you insuring? Is it a city bike or perhaps a mountain bike? |

| Purchase value | This is how much you paid for the bicycle. You need to be able to show this amount using a recent (i.e. younger than 6 months old) receipt. If you bought the bicycle longer than 6 months ago, you need to have an authorized bicycle dealer confirm the value. |

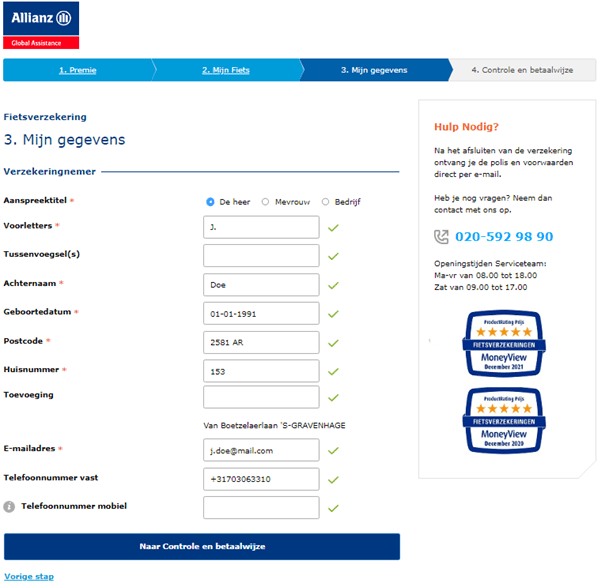

| Postal code / ZIP code | Where you live affects your premium. Example: 2581 AR |

| Manufacturing year | This is the year the bicycle was made. If you are the first owner of the bicycle, please use the current year. |

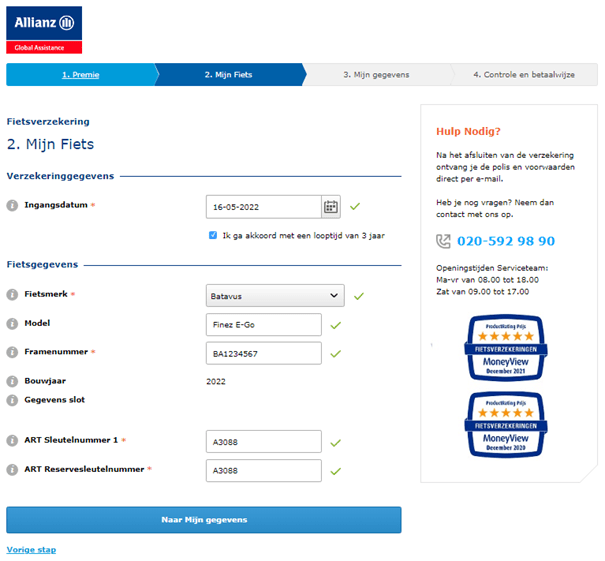

| Brand and model | For instance, VanMoof S5 |

| Frame number | E.g. BA1234567. This number always starts with two letters followed by seven numbers. You can find this number on the receipt or purchase invoice. |

| ART key numbers | Every bicycle key has a unique number |

Step-by-Step Plan

By clicking on the button below, you end up on the e-bike landing page from Allianz Global Assistance. But for now, keep reading a little bit.

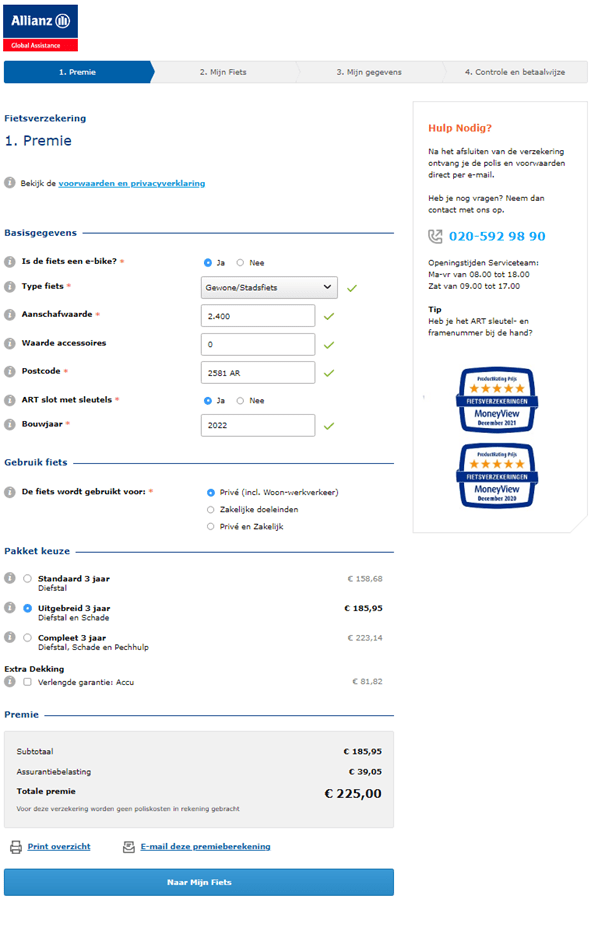

Click on “Bereken premie” to start a premium calculation.

Next you select the bicycle insurance (and possible the package) that you want to take out. In this example we chose the Aflopende Fietsverzekering (= Temporary bicycle insurance).

To calculate your premium, you provide answers to the questions below. In this example, we are insuring a regular e-bike worth € 2,400 which has a two-star ART lock and we intend to use the[a1] e-bike for private purposes only.

Thankfully, this includes commuting to work. Yeah!

At the bottom of the premium calculation, you have the option to print out or send the quote to yourself via e-mail. In order to take out the bicycle insurance, please click on “Naar Mijn Fiets” to continue.

The next screen will ask other important (bicycle) details.

In step 3, you need to provide your personal details such as your name, date of birth and e-mail address.

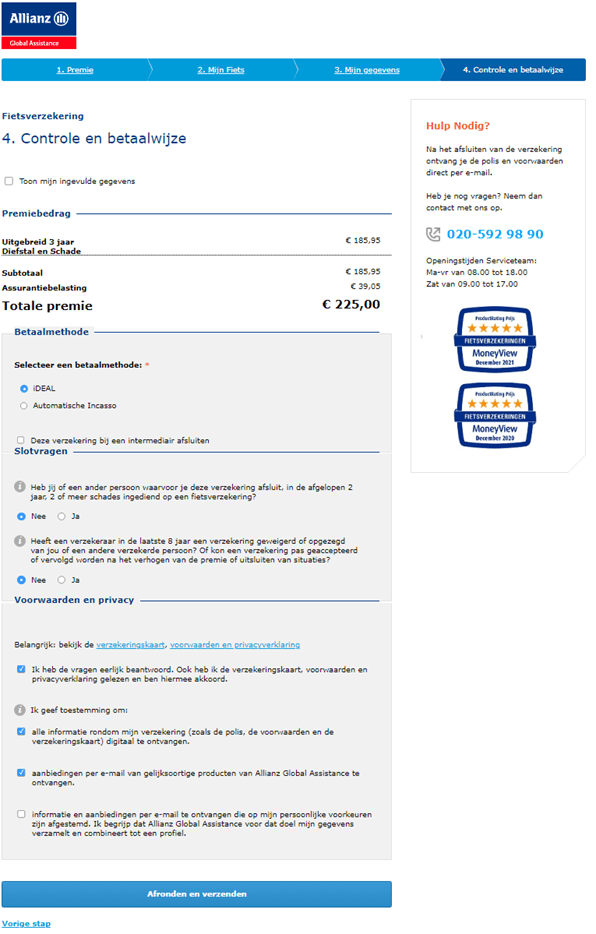

In the fourth and final step, you can see all the details you have filled in. You need to select your desired payment method and Allianz Global Assistance will ask some closing questions.

Tip

Tip

It is a requirement that every bike has an approved lock. Meaning it has a minimum 2-star ART-rating. Any bike shop will know if your bike has one.

The Holland Handbook 2024

It is that time of year again; the new and annually-updated version of The ...

Dutch Taxes

Taxes are always complicated. If you have moved to the Netherlands from another country they ...

The UnDutchables 9.0

Following the legendary previous eight editions of The UnDutchables, the 9th edition of this all ...

Making the most of your Dutch home

Whether you are renting, staying in a long-term AirBNB or have just bought a ...

Gift giving in the Netherlands-all ...

If you feel like skipping your birthday, you may be in for a challenge when ...

10 things you will find in every Du ...

The Dutch are very fond of houseplants, the more the merrier! You will find the ...

Obtaining a Mortgage as an Expat in ...

Obtaining a mortgage as an expat in the Netherlands can be a complex process, as ...

Help me move to the Netherlands!

Obviously, the decision to move to the Netherlands is not one to be taken lightly ...

The Impact of Technology on Educati ...

Education is unending and pivotal in society. Technology is one of the most dynamic entities ...

Five Renovation Tips to Increase yo ...

Learn how much home renovations cost – and which repairs increase the home value, and which ...